DDR5 prices set to improve in 2022, but don't expect any miracles

Why information technology matters: The fleck shortage, high demand, and scalpers have all contributed to a situation where new hardware is difficult to find in stock and consumers have to either pay a profoundly inflated toll or play the waiting game. In the instance of DDR5 DRAM, it makes more than sense to play the waiting game, equally getting your easily on a kit that'southward reasonably priced could remain a challenge in the coming months.

If you've been contemplating a PC upgrade that involves DDR5 retention, chances are you already know that such kits suffer from poor availability, non to mention the continuing problem of scalpers grabbing every last one to sell at inflated prices that reach as high as $2,500.

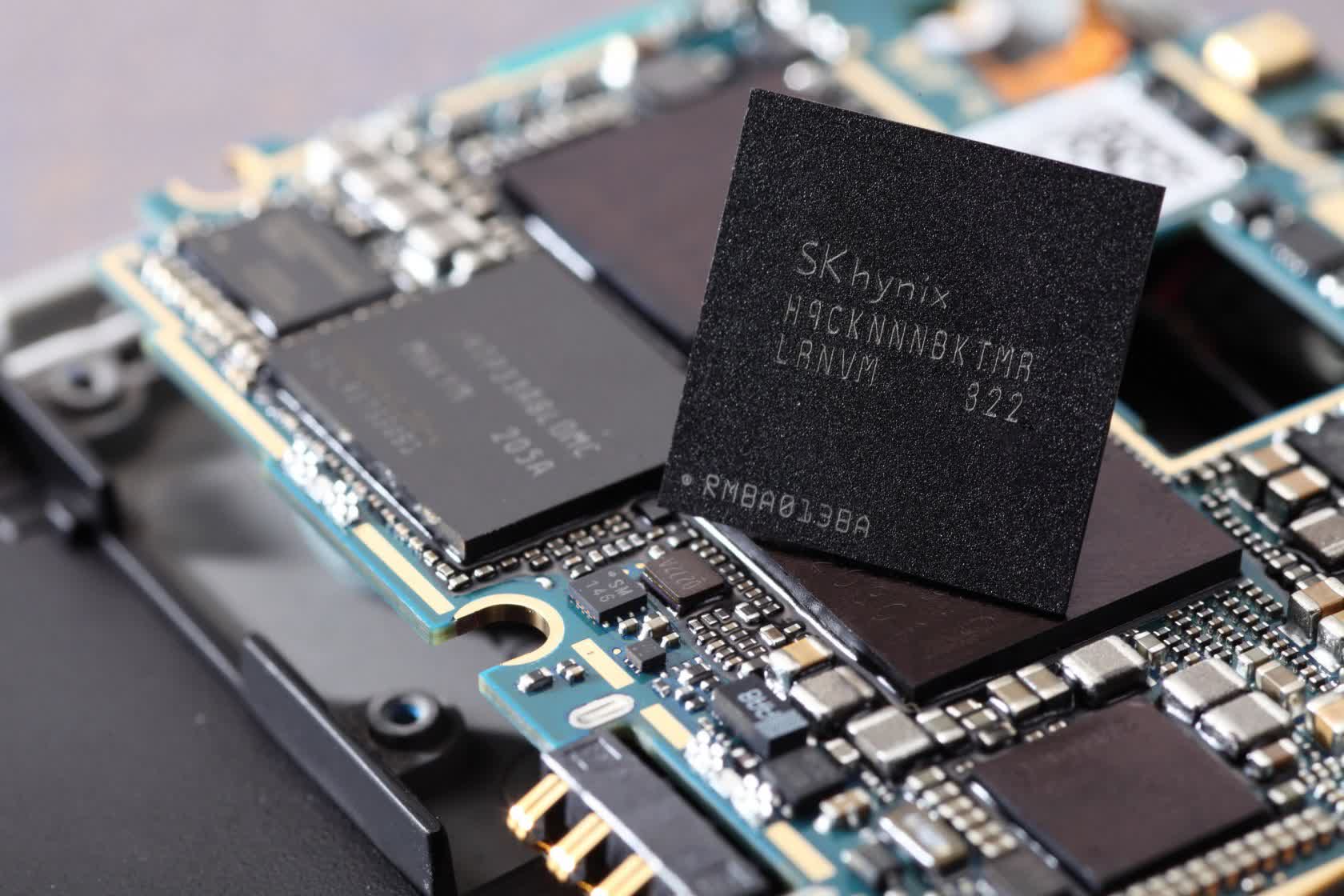

The main reason is, of course, the ongoing chip shortage. Withal, information technology's not the lack of DDR5 chips, but rather the lack of power management integrated circuits (PMICs) that has led to this state of affairs. Manufacturers are actively trying to improve production capacity, only that can't exactly happen overnight.

Availability won't improve much in the coming months, simply the average selling price could see a modest decrease. According to a report from TrendForce, the cost of DDR5 modules could fall past anywhere betwixt 3 to eight percent in Q1 2022. In the example of DDR4 modules, the cost could decrease by as much as x per centum as a result of PC OEMs trying to reduce inventory during the holiday shopping flavor.

This won't necessarily make a huge deviation for your wallet but is indicative of a slow, gradual comeback in supply for DRAM that could eventually brand DDR5 scalpers lose interest. Correct now you can only employ DDR5 with a handful of Intel Alder Lake CPUs, but that volition change every bit Intel launches additional models and suppliers ramp up product.

There is at present an crowd of mobile DRAM, but that hasn't helped in the current context where telephone makers have trouble securing a constant supply of various other components. TrendForce expects mobile DRAM prices to decrease betwixt 8 to 13 percentage in the first quarter of next year, especially equally smartphone sales take taken a hit and created inventory pressure level for both suppliers and phone makers.

In the case of graphics DRAM, suppliers are now gradually shifting from 8 Gb to 16 Gb GDDR6 chips, with Micron leading the transition. However, since almost chips used for consumer graphics cards are even so of the 8 Gb diversity, the high need means prices won't improve and at best will remain flat in the coming months.

Source: https://www.techspot.com/news/92642-ddr5-prices-set-improve-2022-but-dont-expect.html

Posted by: kinghistorl.blogspot.com

0 Response to "DDR5 prices set to improve in 2022, but don't expect any miracles"

Post a Comment